03 May 2025

With the implementation of Real Estate (Regulatory and Development) act-2016 (RERA) in the state of Uttar Pradesh, the registration of property will be executed on the basis of carpet area against the ongoing registration in which property registration is executed on the basis of carpet areas and super areas.

Expert says that an individual buyer will breathe some relief as he will have to deposit registration charge of areas that are within four walls of the homes while registering properties with the registrar of stamp and duty. This much portion of home of a particular housing complex will be registered in the name of individual home buyer.

As a landmark year for the real estate industry draws to a close, it’s time to review the major events of 2017 for Indian real estate and look at some upcoming trends in 2018.

For the real estate industry, 2017 was a watershed year, with the roll-out of game-changing policies such as GST and RERA. Demonetization’s impact started to taper off slightly, while real estate investment trusts (REITs) did not take off this year as expected. Affordable housing came out of the shadows and affordably-priced units have been selling like hot cakes in most cities.

NCR has witnessed a 3-5% decrease in average per-square-foot property prices over the last one year (Q4 2016 - Q3 2017). Currently, NCR has the maximum number of unsold units among all the top cities in India. An approximate 2 lakh unsold units are stocked up across different cities in the region. Greater Noida has maximum share of unsold inventory, followed by Gurugram.

There are many reasons for the price decrease in NCR. To begin with, excessive delay in project construction and possession has hurt buyers’ sentiments and led to subdued demand. Also, many projects have been stalled due to agitations and litigation issues. The massive unsold inventory itself has acted as a sentiment suppressant - and finally, while demonetization, RERA and GST are potentially positive moves for the industry, they have played a significant role in reduced buyer sentiment, contributing to the price falls.

New Delhi: A month after adjudicating officers was appointed, the Uttar Pradesh Real Estate Regulatory Authority (UPRERA) has seen steep rise in number of complaints being lodged against private housing project developers in the state.

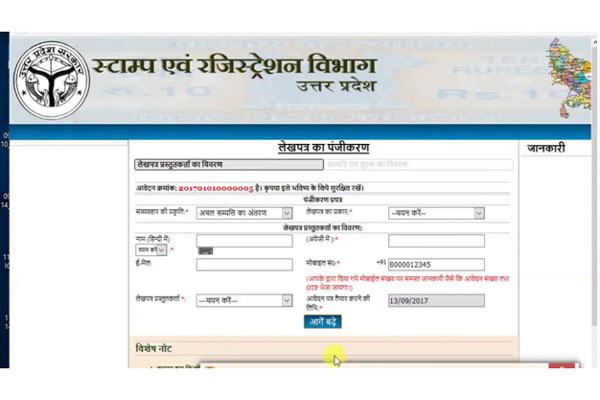

Maximum numbers of complaints were moved by home buyers and their associations to UPRERA are from Noida and Greater Noida in Gautam Buddha Nagar. These complaints are different nature including delayed of possession of homes, pending registration of sold properties with department of stamp and registration.