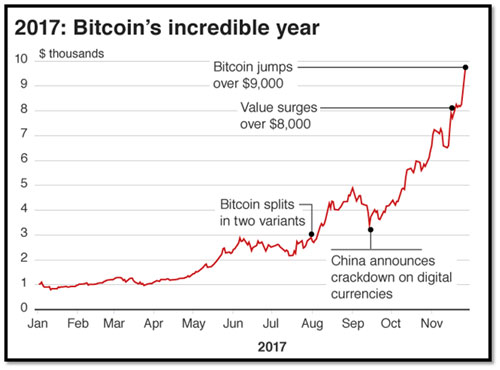

New Delhi: The controversial digital currency Bitcoin has soared to an all-time high after its price rocketed more than 15 per cent over the weekend.

As it stood on November 27, a single Bitcoin was valued at a staggering £8015 ($10,740) an 800 per cent rise since the start of the year.

The move takes it to 20% above the level it stood at on Friday last, according to the Luxembourg-based Bitcoin exchange, Bitstamp. It started the year at around $1,000.

The total market capitalization for the cryptocurrency market has exceeded $300 billion for the first time.

Data from CoinMarketCap.com shows that the market capitalization for all cryptocurrencies is currently at roughly $300.5bn. Of that amount, bitcoin's market cap represents the lion's share, accounting for about $158 billion.

The move comes as the price of bitcoin continues its surge above $9,000, trading at roughly $9,482, according to the CoinDeskBitcoin Price Index (BPI).

The push above $300 billion perhaps also showcases the pace at which the market has grown in recent weeks. On Nov. 3rd, the overall market capitalization rose above $200 billion for the first time. By contrast, the market crossed the $100 billion level back in June.

Virtual currencies are largely unregulated and bypass traditional banking systems. Their growth is of increasing concern to international regulators.

China and South Korea have banned any new virtual currency launches and have been shutting down exchanges on which they are traded.

Currencies such as Bitcoin use blockchain, which is an online ledger of transactions maintained by a network of anonymous computers on the internet.

They are neither backed by any government nor central bank and therefore there is no-one responsible for backing their value.

Bitcoin has always been a hot topic and a frequent point of discussion among investors, entrepreneurs and stock traders, but with the recent boost in the value of bitcoin it has managed to grab eyeballs of every individual around. So let’s understand what Bitcoin is.

Here is the lowdown:

How Bitcoins Started?

Although it took until 2009 for a mysterious person calling themselves Satoshi Nakamoto to introduce the idea of Bitcoin, the concept of crypto-currency actually stems from a 1998 publication by a man named Wei Dai.

What began as an idea for a way to create an economy outside the constraints of the federal government quickly gained momentum and has now become a multi-million dollar a year global financial system.

What Is Bitcoin?

Every person who either earns or uses Bitcoin has control over their part of the entire network. There are no middlemen or owners at all. Each individual holds a personal Bitcoin wallet that accepts deposits and makes payments from a variety of online places.

According to the latest numbers from Bitcoin.org, the total value of all Bitcoins circulating is approximately US $1.5 billion. Many individuals and businesses, to include everything from online retail giant Overstock to physical shops like REEDs Jewelers, now accept this crypto-currency.

How do Bitcoins work?

The value of Bitcoin, like all currencies, is determined by how much people are willing to exchange it for.

To process Bitcoin transactions, a procedure called 'mining' must take place, which involves a computer solving a difficult mathematical problem with a 64-digit solution.For each problem solved, one block of Bitcoin is processed.

In addition, the miner is rewarded with new Bitcoin.To compensate for the growing power of computer chips, the difficulty of the puzzles is adjusted to ensure a steady stream of new Bitcoins is produced each day.

There are currently about 16 million in existence.The Bitcoin protocol – the rules that make Bitcoin work – say that only 21 million Bitcoins can ever be created by miners.

However, these coins can be divided into smaller parts with the smallest divisible amount one hundred millionth of a Bitcoin.This is called a "Satoshi", after the founder. To receive a Bitcoin, a user must have a Bitcoin address - a string of 27-34 letters and numbers - which acts as a kind of virtual post box.

Since there is no register of these addresses, people can use them to protect their anonymity when making a transaction. These addresses are in turn stored in Bitcoin wallets, which are used to manage savings.

What is Bitcoin Mining?

The easiest way to acquire Bitcoin is to have someone else give it to you either as a gift or through a sales transaction. The currency is created through a process called mining, but it requires specific hardware and insider knowledge these days. Exchanging real-world currencies for virtual currencies allows you to essentially buy Bitcoin as well.

All transactions are handled both privately, with extensive security encryption in place, and publicly for everyone else on the network. This system of checks and balances allows users to maintain some small level of anonymity while making sure no one tries to game the system.

Since there is a cap of 21 million bitcoins in circulation ever, it is important to keep track of where they are and where they’re going.

Benefits of Bitcoin:

There are clear benefits to using Bitcoins, and these benefits explain the Bitcoin’s rise in popularity.

Bitcoin, like all crypto-currencies, are available every hour of every day throughout the year. Transactions are quick, secure, and not reliant on banks or other institutions’ office hours.

The ever-increasing list of companies and individuals who accept this type of payment for products and services includes both online and real-world options.

Transparent fees are the norm, and they are usually lower than you would find if you are trading other currencies such as US dollars or the Euro.

If you are involved in selling a product or service, accepting Bitcoins has benefits as well. Clients or customers cannot reverse payments. You would need to issue a direct refund if they dispute the transaction. Also, the lack of personal information transmitted with the payment means you need to worry less about the security of company databases.

Disadvantages of Bitcoin:

Although the popularity of using virtual currency improves, it still cannot compete with the power and convenience of regular money.

Using a credit card affords more buyer protection because you can file claims and charge-backs. Cash transactions blow every other type of payment acceptance out of the water.

Everything seems to be digital these days, but having your currency stored only on the web or in the cloud creates vulnerability. There is no vault of gold bars backing up Bitcoin. You can’t carry them around in your pocket. If someone hacks into or crashes your online wallet or virtual coin storage, you may lose everything. Lost Bitcoin cannot be retrieved and may end up out of circulation entirely.

Compared to actual currencies around the world, Bitcoin value experiences much more volatility based on the current market trends. This is due primarily to the comparably small number of services and businesses who use it. One small change can create large ripples in the network.

The possibility always exists that international governments will change the rules about crypto-currencies and decimate their value. According to CNN’s latest map, only Iceland and Vietnam have made virtual money against the law. Many other countries, including Russia and China, are in constant dispute about their use.

Because of the assumed privacy of transactions, BitCoin is unfortunately used for illegal activities as well.

What is the value of one bitcoin today?

One bitcoin is worth roughly about $1,200 now. An early investor in Snapchat has been quoted on the Web as saying that by 2030, the value could be as high as $500,000. One of the reasons that could prompt you to buy a bitcoin today is not so much to use it for payment online but as an investment.

Urban legend has it that someone who was doing a thesis on cryptocurrency bought 5,000 bitcoins for $27 in 2009. Do the math for the value today!

And unlike traditional currency that is inflationary in nature, the bitcoin is a deflationary currency. In other words, if there are only so many bitcoins in use, and the demand for those rises, the value of a bitcoin would, logically, rise.

How does the payment system work?

When you send a bitcoin to a receiver, the transaction is included in the blockchain and broadcast to the network. The blockchain ensures that the same bitcoin is not spent twice by the same user. A computer network validates the transaction using algorithms so that the transaction becomes unalterable. Once validated, the transaction is added to others to create a block of data for the ledger.

How is a new bitcoin generated?

A bitcoin is generated when an entity, i.e. a person or a business, uses software power to solve a mathematical puzzle that makes the blockchain more secure. The difficulty level of solving the problem is high enough to ensure that it takes time to do it.

Where do you get bitcoins?

Bitcoins are available in bitcoin exchanges. You could also purchase bitcoins from other users. A bitcoin exchange traded fund could be another source in the near future. You can become a bitcoin miner by investing in software and hardware. The more the power of the hardware is what that helps with encryption technology, higher the probability of your earning bitcoins.

Unocoin is a Bengaluru-based company that allows users to buy, sell, store or use bitcoins. While bitcoin usage is certainly not mainstream, there are said to be more than 500 merchants who accept bitcoins for payment in India.

Bitcoin& Online Trading:

Although people can get Bitcoin and use it to purchase goods or services, others with a more entrepreneurial spirit can learn how to trade this currency and make their virtual wallet grow. This process involves some risk and, due to the ever-changing value, only users with a keen grasp of trading practices and an excellent system behind them should try.

The earning method mimics commodities trading or any type of wholesale-retail transaction: buy low, sell high. In simple terms, you want to purchase Bitcoin at an affordable price and wait until each one is worth more before you sell them again. The difference is profit.

While the process may seem simple, anyone who gets involved needs sufficient knowledge about the marketplace, where to buy and sell from, associated fees, and best practices. Currency trading is not something to jump into blindly. However, if done right and watched closely, it can be quite lucrative.

India’s Very Own Cryptocurrency ‘Laxmi’:

Laxmicoin is a digital cryptocurrency created by Raj Dangi and Silicon Valley-based Mitts Daki. As per the founders, Laxmicoin is expected to have a total coin supply of 30 million that will use blockchain technology to function similar to Bitcoin. However, the 2014 actions by the RBI against Indian bitcoin exchanges forced the founders to postpone the launch. While many bitcoin exchanges have resumed service, Laxmicoin’s founders have been adamant about putting off their launch until they get explicit approval and consent from the RBI.

More countries to launch their own Cryptocurrencies:

In January 2016, China’s National Bank announced to launch its own cryptocurrency. Following China, England also plans the same. Bank of England is also set to launch it’s own cryptocurrency called “RS COIN”.

The RS COIN will also be using Blockchain Technology and working same like Bitcoin but with a major difference, that RS COIN will be centralized.

A news came in late August that Estonia is also willing to launch it’s own cryptocurrency. Estonia’s own cryptocurrency named “Estcoins” for being put to use by Estonian e-residents across the globe conducting business over internet medium has been hogging the limelight since the last few days. This new cryptocurrency form will be developed in association with VitalikButerin, the founder of Ethereum.

Similarly, Russian Central Bank also gave a positive nod to cryptocurrencies and might introduce their own cryptocurrency. The Russian central bank will also start imparting education about the cryptocurrency plethora amongst common masses.

References:

http://www.bbc.com

https://www.coindesk.com

https://www.thesun.co.uk

http://www.thehindu.com/

https://www.warriortrading.com

https://kryptomoney.com